Little Known Facts About Best Investment Books.

Wiki Article

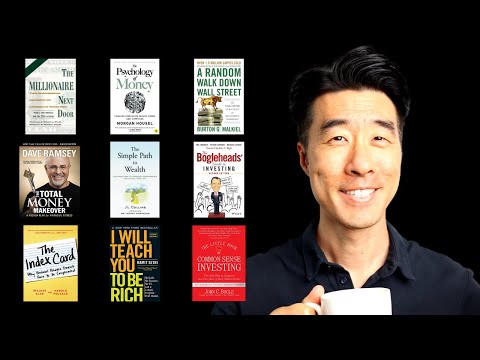

The top Investment decision Publications

Considering getting a better investor? There are plenty of books which can help. Profitable traders read extensively to create their capabilities and remain abreast of rising strategies for financial commitment.

Best Investment Books for Dummies

Benjamin Graham's The Clever Investor is an indispensable guideline for any Trader. It covers everything from fundamental investing tactics and chance mitigation techniques, to value investing methods and tactics.

Benjamin Graham's The Clever Investor is an indispensable guideline for any Trader. It covers everything from fundamental investing tactics and chance mitigation techniques, to value investing methods and tactics.1. The Little E book of Popular Feeling Investing by Peter Lynch

Prepared in 1949, this basic do the job advocates the value of investing having a margin of basic safety and preferring undervalued stocks. A must-study for anybody thinking about investing, specifically Those people hunting past index funds to determine distinct superior-worth extended-expression investments. On top of that, it addresses diversification principles along with how to stay away from currently being mislead by industry fluctuations or other investor traps.

This e book delivers an in-depth tutorial regarding how to come to be a successful trader, outlining every one of the principles every trader need to know. Topics mentioned within the e-book range from market psychology and paper trading tactics, staying away from common pitfalls such as overtrading or speculation plus much more - earning this book vital studying for significant buyers who want to assure they have an in-depth familiarity with essential investing concepts.

Bogle wrote this complete reserve in 1999 to drop light over the hidden charges that exist within mutual money and why most investors would advantage much more from purchasing low-price index resources. His assistance of conserving for rainy working day money while not positioning your eggs into one basket together with purchasing reasonably priced index funds remains valid nowadays as it was back again then.

Robert Kiyosaki has prolonged championed the necessity of diversifying cash flow streams through real estate property and dividend investments, especially housing and dividends. When Rich Father Lousy Father may possibly slide a lot more into personalized finance than private growth, Rich Father Weak Dad stays an insightful go through for anyone wishing to raised fully grasp compound curiosity and the way to make their dollars work for them rather than versus them.

For something much more modern day, JL Collins' 2019 e book can provide some Substantially-essential viewpoint. Intended to address the wants of financial independence/retire early communities (FIRE), it focuses on reaching money independence as a result of frugal living, low cost index investing along with the 4% rule - as well as ways to lower scholar loans, spend money on ESG property and reap the benefits of on line financial investment methods.

two. The Little E book of Stock Current market Investing by Benjamin Graham

Serious about investing but unsure ways to move forward? This book offers sensible steering penned precisely with younger traders in your mind, from major student personal loan personal debt and aligning investments with individual values, to ESG investing and on line economic methods.

This finest expense book shows you ways to identify undervalued stocks and build a portfolio that can provide a regular supply of revenue. Utilizing an analogy from grocery browsing, this most effective ebook discusses why it is more prudent not to give attention to high priced, effectively-promoted items but instead think about small-priced, overlooked types at gross sales costs. In addition, diversification, margin of basic safety, and prioritizing benefit around progress are all reviewed thoroughly in the course of.

A typical in its field, this guide explores the fundamentals of price investing and how to detect alternatives. Drawing on his expenditure firm Gotham Resources which averaged an annual return of forty % during 20 years. He emphasizes staying away from fads whilst purchasing undervalued businesses with solid earnings potential clients and disregarding quick-expression sector fluctuations as vital principles of thriving investing.

This finest expenditure ebook's creator gives advice for new buyers to steer clear of the problems most novices make and maximize the return on their own revenue. With move-by-phase instructions on making a portfolio created to steadily develop over time and the author highlighting why index money deliver probably the most productive suggests of financial investment, it teaches visitors how to keep up their program irrespective of market fluctuations.

Best Investment Books - Questions

Even though initial released in 1923, this reserve stays an priceless guideline for anyone thinking about taking care of their finances and investing wisely. It chronicles Jesse Livermore's ordeals - who earned and dropped hundreds of thousands in excess of his lifetime - while highlighting the importance of chance theory as Portion of choice-creating processes.

Even though initial released in 1923, this reserve stays an priceless guideline for anyone thinking about taking care of their finances and investing wisely. It chronicles Jesse Livermore's ordeals - who earned and dropped hundreds of thousands in excess of his lifetime - while highlighting the importance of chance theory as Portion of choice-creating processes.Should you be looking for to enhance your investing competencies, there are actually many great books to choose from that you should pick. But with restricted hrs in per day and restricted available examining materials, prioritizing only People insights which offer probably the most benefit can be difficult - Which is the reason the Blinkist application presents these easy access. By accumulating critical insights from nonfiction guides into Chunk-sized explainers.

three. The Little E book of Price Investing by Robert Kiyosaki

Best Investment Books for Beginners

This book handles investing in enterprises having an financial moat - or competitive edge - such as an financial moat. The author describes what an have a peek at this web-site financial moat is and gives samples of a lot of the most renowned firms with a person. On top of that, this book details how to find out a firm's benefit and purchase shares Based on cost-earnings ratio - ideal for starter traders or everyone attempting to find out the fundamentals of investing.

This book handles investing in enterprises having an financial moat - or competitive edge - such as an financial moat. The author describes what an have a peek at this web-site financial moat is and gives samples of a lot of the most renowned firms with a person. On top of that, this book details how to find out a firm's benefit and purchase shares Based on cost-earnings ratio - ideal for starter traders or everyone attempting to find out the fundamentals of investing.This doorstop investment decision ebook is both common and detailed. It covers a lot of the most effective tactics of investing, for example beginning youthful, diversifying extensively and not having to pay higher broker expenses. Penned in an enticing "kick up your butt" design and style which may either endear it to readers or flip you off fully; when masking lots of common pieces of advice (commit early when Other individuals are greedy; be cautious when others come to be overexuberant), this textual content also endorses an indexing tactic which intensely emphasizes bonds in comparison to many equivalent procedures.

This book provides an insightful method for inventory choosing. The author describes how to select winning stocks by classifying them into six get more info distinct classes - slow growers, stalwarts, fast growers, cyclical shares, turnarounds and asset plays. By next this clear-cut technique you increase your odds of beating the market.

Peter Lynch has become the earth's Leading fund managers, obtaining run Fidelity's Magellan Fund for 13 a long time with an average return that beat the S&P Index annually. Revealed in 2000, his e-book highlights Lynch's best investment books philosophy for choosing shares for unique traders in an accessible method that stands in stark distinction to Wall Street's arrogant and overly technical tactic.